How Taxes and Tax Cuts Work

Let's put them in perspective.

Much has been made of “tax cuts only benefiting the rich” so let's put them in terms everyone can understand.

Suppose that every week, ten friends go out for dinner. The bill for all ten comes to $100. If each were responsible for his/her share of the bill, that would be $10 each. Instead, they decided to divide the bill based upon their ability to pay, using the way we pay our federal income taxes as a guide, so this is how it went:

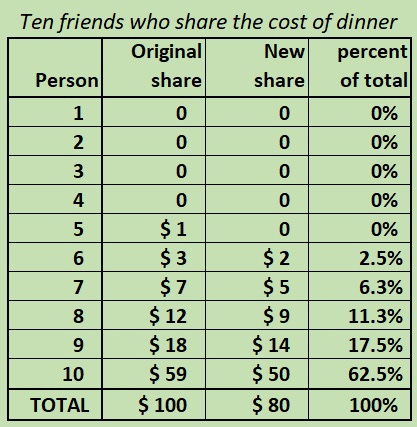

The first four — the poorest — would pay nothing; the fifth would pay $1, the sixth would pay $3, the seventh $7, the eighth $12, the ninth $18, and the tenth person — the wealthiest — would pay $59. Seems more than fair, right?

So that's what they decided to do. The ten folks ate dinner in the restaurant every week and seemed quite happy with the arrangement — until one week, the owner threw them a curve (in tax language, a tax cut).

"Since you are all such good customers," she said, "I'm going to reduce the cost of your meal by $20." So now dinner for the ten only cost $80. Who doesn’t like a 20% discount!

The group still wanted to pay their bill the way we pay our taxes. So the first four were unaffected. They would still eat for free. But what about the other six — the paying customers? How could they divvy up the $20 windfall so that everyone would get their "fair share?"

These six realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, the fifth person and sixth person would end up being PAID to eat their meal. So the restaurant owner suggested that it would be fair to reduce each person's bill by a "reasonable" amount, and she proceeded to work out the amounts each should pay.

And so the fifth person now paid nothing, the sixth pitched in $2, the seventh paid $5, the eighth paid $9, the ninth paid $14, leaving the tenth guy with a bill of $50 instead of his earlier $59. Each of the six was better off than before. And the first four continued to eat for free. Here’s a table of the original and new obligations to cover the cost of everyone’s meals.

But once outside the restaurant, they began to compare their savings. "I only got one dollar out of the $20," declared the sixth person who pointed to the tenth. "But he got $9!"

"Yeah, that's right," exclaimed the fifth person, "I only saved a dollar, too . . . It's unfair that he got nine times more than me!".

"That's true!" shouted the seventh person, "why should he get $9 back when I got only $2? The wealthy get all the breaks!"

"Wait a minute," yelled the first four folks in unison, "We didn't get anything at all. The system exploits the poor!"

The nine people surrounded the tenth and voted him off the island (some say he left to go overseas). The next week he didn't show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they discovered, a little late, something they should have thought of before they drove him away. They were FORTY-TWO DOLLARS short of paying the $72 dollar bill! Imagine that!

And that's how the tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just might not show up at the table anymore. Note that after the discount, the wealthiest person was paying an EVEN HIGHER PERCENTAGE of the bill (62%) yet nobody noticed that. Instead of appreciating that everyone else was paying a smaller percentage of the bill, and every one of them was paying less, they were distracted by those rattling the cage for their own benefit. And the mainstream “activist” media continued to trumpet that the tax cuts only benefited the rich despite the fact that the rich pay by far the most both before and after, and that everyone was significantly better off afterwards.

Some of us have jobs where we see first-hand the effects of tax policy, specifically jobs being moved overseas where tax rates are lower. Since one thing ALL of us want is more and better jobs (better paying, better benefits and better work/life balance), let's think about the impact tax policy has on job creation by small business and large business alike. If we put our heads together, we can increase revenues to reduce the deficit and start paying off our debt WITHOUT creating disincentives to business seeking to grow.

It's fair to discuss how progressive our tax structure should be, yet how many of us know how progressive it already is and who's carrying the load? How many appreciate that it's not just a question of how to split up the pie (i.e., what is fair), but also how big is the pie we split up? Let's not do things today that will cause the pie to shrink tomorrow by making it harder for business to operate in our country. The best way to make sure those few wealthy who don’t pay their fair share pay more is to eliminate special carve-outs that only benefit some of the wealthy. The easiest way to be fair to all is to have a growing economy.

Note- this story is adapted with current numbers from a similar story (author unknown) that’s been passed around by email for decades. A classic that still rings true today.

note- this post was taken from this Substack article.

Comments

Post a Comment